How The SECURE Act Affects 401(k)s

Recently, Congress passed one of the largest changes to the retirement plan industry in a decade.

The Setting Every Community Up for Retirement Enhancement Act, also known as The SECURE Act, has been years in the making.

The SECURE Act covers a lot of territory for retirement plans and 401(k)s and it’s fairly clear that the objective was to motivate employers to offer a retirement plan to their employees in order to give them an easy way to start saving for their retirement.

Below, we cover 3 main areas of how The SECURE Act affects 401(k)s through tax-credits, extensions, and increases.

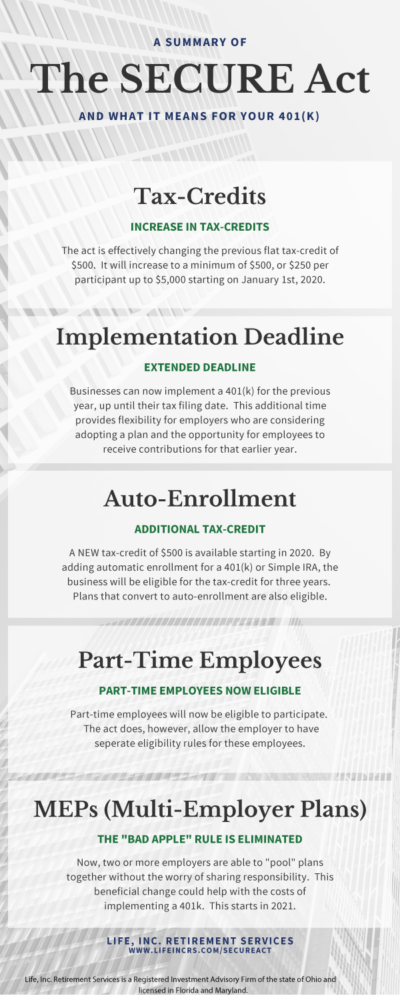

Increase In Tax-Credits

Previously, employers who had implemented a 401(k) for their company received a flat $500 tax-credit. For many, this wasn’t enough incentive to offer a 401(k) plan due to the associated costs of administration.

Under The SECURE Act, employers will enjoy a minimum of $500, with a maximum of $5,000 for up to three years. The final amount depends on how many employees sign up for the plan. With each eligible employee, whether they participate or now, the employer will receive a $250 tax-credit, no less than $500.

Unfortunately, the calculation does not include Highly Compensated Employees, also known as HCEs.

In addition, The SECURE Act offers an additional $500 tax-credit for those 401(k) or Simple IRA plans who use automatic enrollment for their participants.

Automatic enrollment, often called auto-enrolment, shifts the process of the employee from opting into a plan to opting OUT of the plan. The idea behind this is to urge the employees to make a quicker decision on their retirement savings.

Often, employees want to sign up for the plan, but never actually sign up because of a hectic work or family life.

Extension of the Implementation Deadline

This is another significant change derived from The SECURE Act.

Employers now don’t need to worry about a December 31st deadline to decide if they want to implement a 401(k) or Cash Balance plan. They now have up until their tax filing date (including extensions) to decide whether they would like to implement a plan for the previous year.

Simply put, this is a tax play, but be careful, as the employee deferrals portion likely won’t be able to be made retroactively since W-2’s will already be filed.

Previously, if you wanted to get any tax deductions through 401(k) contributions for the current year, you would need to start the retirement plan by the end of that year. With the passing of The SECURE Act, employers are now able to contribute up until the filing date for the previous year.

This rule goes into effect for plans starting in 2020 for the 2020 tax year.

This won’t be eligible for the 2019 tax year.

Eligible Part-Time Employees

Prior to the passing of The SECURE Act, employers could exclude part-time employers when offering a 401(k) plan for their company.

Now, employers are required to maintain dual eligibility requirements in order to include their part-time employees. This means that along with their eligibility requirements they set for full-time employees, they are allowed to have a second set of eligibility requirements for their part-time employees.

The rules for part-time employees can be either of the following:

- The employee is required to complete one year of service with at least 1,000 hours.

- The employee is required to have at least 500 hours of service for three consecutive years.

If the employee completes the latter, then the employer is able to exclude them from any nondiscrimination and coverage rules. This helps with distributing excess contributions to HCEs. Employers can always be more generous and include part-time employees and have shorter eligibility, but many small businesses choose not to to help lower costs.

In Summary

We see the passing of The SECURE Act as a positive for small businesses.

These incentives give the employer a way to offset the costs associated with a retirement plan that helps with recruiting high-quality employees, employee retention, and tax management.

Contact us for a free consultation or head over to the Retirement Plan Evaluator to see which plan is best for your business.